BIN Lookup is the process of identifying information about a payment card by checking its Bank Identification Number (the first 6–8 digits of a card). This data reveals the card type (credit, debit, prepaid), issuing country, brand (Visa, Mastercard, UnionPay, etc.), and often the issuing bank. Originally designed for routing transactions, BIN Lookup today plays a central role in fraud prevention, compliance, and personalization.

As global payments have shifted online, real-time BIN Lookup has become critical for merchants, PSPs, and fintech companies. It helps block suspicious transactions, apply local payment rules, and enhance customer experience by predicting acceptance rates. The recent move to 8-digit BINs aims to future-proof the system against card volume growth, though it also creates data management challenges. Experts highlight that while BIN data is powerful, outdated or misused BIN lists can lead to false positives or compliance risks, making fresh data and privacy safeguards essential.

What Is BIN Lookup?

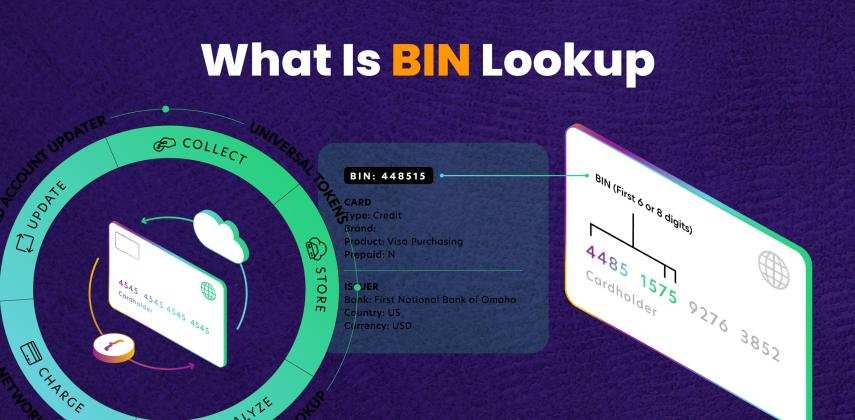

BIN Lookup, also known as IIN Lookup (Issuer Identification Number Lookup), is the process of identifying information about a payment card by checking its Bank Identification Number — the first 6 to 8 digits of a card number.

These digits reveal key details such as the card type (credit, debit, prepaid), issuing country, card brand (Visa, Mastercard, UnionPay, etc.), and often the issuing bank itself.

Originally designed for routing transactions, BIN Lookup today plays a central role in fraud prevention, compliance, and payment optimization.

With global payments shifting online, real-time BIN Lookup has become essential for merchants, fintechs, and PSPs to block suspicious transactions, apply local payment rules, and enhance customer experience.

The recent move to 8-digit BINs future-proofs the system against rising card volumes but adds new data-management challenges. Keeping BIN data fresh and privacy-compliant is now critical for accuracy and trust.

BIN in the Context of PAN (Primary Account Number)

A payment card’s 16-digit number is officially called the Primary Account Number (PAN). The BIN represents its first 6–8 digits, followed by the individual account identifier, and ending with a checksum digit.

Each section of the PAN plays a distinct role:

✅ BIN / IIN: identifies the issuing bank or institution.

✅ Account Identifier: links the physical card to the customer’s specific account.

✅ Checksum Digit: ensures mathematical validity through the Luhn algorithm.

Understanding this relationship clarifies how BIN Lookup decodes the entire PAN structure to validate transactions in real time.

A Brief History and Evolution

The BIN system originated in the late 20th century to streamline card routing within growing global networks. Initially, 6-digit BINs were sufficient, but rapid growth in card issuance—especially by fintech platforms—led payment networks to expand BINs to 8 digits.

For example, Mastercard’s 8-Digit BIN Expansion (2022) prevented BIN collisions and opened capacity for new issuers and card products. This required ecosystem-wide updates, from merchant checkout systems to fraud detection APIs.

The terms Bank Identification Number (BIN) and Issuer Identification Number (IIN) are used interchangeably under ISO/IEC 7812. While BIN was the historical term, “IIN” became the global standard. Both refer to the same concept — the first 6–8 digits identifying the issuing bank.

The Structure of a Credit Card Number (PAN)

Every card number, known as a Primary Account Number (PAN), follows a standardized structure:

MII (Major Industry Identifier): 1st digit — defines industry sector (e.g., 4–5 for banking, 3 for travel).

BIN/IIN: Next 5–7 digits — identify issuing bank and network.

Account Identifier: Middle digits — unique per customer account.

Checksum (Luhn Digit): Final digit used for mathematical verification.

How Does a BIN Lookup Tool Work (Step-by-Step)?

A BIN Lookup service maintains an updated BIN database with metadata for each known BIN range. Here’s how the process works:

Card Entry: When a card number is entered online, only the first 6–8 digits (the BIN) are extracted.

Database Query: The payment processor or API sends this BIN to a lookup database—either internal or external.

Instant Match: The database identifies the issuer, brand, card type, and country of issuance.

Validation: The final digit of the card number (the checksum) is verified using the Luhn algorithm (mod-10) to ensure it’s a valid card pattern.

Response: The result returns key card details used for fraud checks, routing, and compliance rules.

Major Industry Identifier (MII)

The first digit of every BIN is the MII (Major Industry Identifier), which defines the industry of the issuer:

| MII Digit |

Industry |

| 1–2 |

Airlines |

| 3 |

Travel & Entertainment |

| 4–5 |

Banking & Financial |

| 6 |

Merchandising |

| 7 |

Petroleum |

| 8 |

Telecom & Healthcare |

| 9 |

National / Future Assignments |

BIN Range & BIN Directory

BINs are grouped into ranges owned by specific banks or networks.

A BIN directory tracks these ranges, ensuring every new 6- and 8-digit BIN remains uniquely tied to its issuer — vital for accurate lookups and preventing overlap.

Why Vizovcc Uses BIN Lookup to Protect Your Payments

At Vizovcc, we integrate advanced BIN Lookup tools into our payment system to make every transaction instant, secure, and compliant. By identifying each card’s issuing bank, type, and country, Vizovcc detects fraud risks, optimizes routing, and adheres to global standards such as PCI DSS and PSD2.

Combined with AI-based fraud detection, our BIN engine prevents suspicious activity while ensuring seamless experiences for merchants and customers worldwide.

👉 Experience real-time protection — Create your Vizovcc account today.

Examples of BIN Data (Mock Table)

Use a compact table to show what BIN lookup typically returns. (Sample data for illustration only.)

| BIN / IIN |

Brand |

Issuer (Bank) |

Type |

Country |

| 411111 |

Visa |

Example Bank |

Credit |

US |

| 545721 |

Mastercard |

Sample Financial |

Credit |

US |

| 522653 |

Mastercard |

Demo Bank |

Debit |

GB |

| 343889 |

American Exp |

Example Issuer |

Charge |

US |

| 440393 |

Visa |

Cash App (ex.) |

Prepaid |

US |

BIN Range and the 8-Digit Expansion

Most providers historically indexed 6-digit BINs; networks are expanding to 8-digit BINs to accommodate issuer growth.

Why it matters:

Coverage & accuracy: Your bin range lookup and bin database lookup must map 6- and 8-digit ranges to avoid MULTIPLE/NO MATCH results.

Routing & rules: Fraud/checkout rules tied to legacy 6-digit BINs may miss nuance in 8-digit ranges.

API readiness: Choose a bin lookup API that explicitly supports 8 digit bin lookup and publishes update cadence/change logs.

BIN Lookup Accuracy & API Comparison (What to Evaluate)

When comparing bin lookup services (incl. free bin lookup tool options), highlight:

Update Frequency: Daily/weekly vs. ad-hoc; published changelog.

Data Sources: Single source, crowdsourced, or multi-sourced with reconciliation.

8-Digit Support: First-class support for 8-digit BINs + clear behavior on MULTIPLE/NO MATCH.

Returned Fields: Brand, type, funding source, country, issuer name, binLength, accountPrefix, level (consumer/commercial/corporate), fast funds eligibility.

Error Handling & SLAs: Timeouts, 429 throttling, 4xx/5xx strategy, uptime.

Security & Compliance: Logging, IP allowlists, PCI DSS, data minimization.

Docs & SDKs: REST examples, sandbox, sample responses; references to popular ecosystems (e.g., binlist.net, Cybersource bin lookup, Mastercard developers bin lookup api features, Stripe bin lookup api features).

Cost & Terms: Free tier vs. free bin/iin lookup api no key limits; rate caps; enterprise support.

BIN Lookup Use Cases: Fraud Prevention, Compliance & Card Issuing

🔒 Fraud Prevention

Identify high-risk cards (prepaid, offshore, or mismatched countries) before authorization.

🌍 Compliance & Risk Control

Apply geo-specific regulations and sanction screening based on the BIN’s issuing country.

💳 Card Issuing & Marketing

Recognize co-branded and corporate cards to design loyalty programs or manage expense categories.

📊 Transaction Routing

Select the optimal processor to improve approval rates and reduce transaction fees.

🤖 Analytics & Segmentation

Segment customers by brand or issuer for targeted offers and behavior insights.

What are its real-world uses? (fraud prevention, card issuing, compliance, marketing)

Fraud prevention: Identify potentially high-risk cards (like prepaid or cards from certain countries) before authorizing a transaction.

Compliance: Apply geo-specific rules, tax regulations, or sanctions screening based on the card’s issuing country.

Improve checkout experience: Instantly detect card brand and type to auto-fill fields or show correct payment options.

Transaction routing: Choose the best payment processor or network to lower fees and improve approval rates.

Analytics & marketing: Segment customers by card type, brand, or issuer for tailored offers and insights.

Detect test cards or suspicious patterns: Spot and block common fraud attempts using known BINs.

Who uses BIN Lookup tools? (banks, fintechs, merchants)

Merchants & e-commerce platforms: To detect card type, improve checkout flow, and reduce fraud and chargebacks.

Payment service providers (PSPs) & gateways: To route transactions efficiently and apply fraud rules in real time.

Banks & card issuers: For risk assessment, portfolio management, and transaction monitoring.

Fintech companies: To build real-time fraud detection tools, digital wallets, and personalized payment solutions.

Fraud prevention & analytics platforms: To enrich transaction data and identify suspicious activity.

Regulatory & compliance teams: To ensure transactions comply with local and international rules based on card issuer country.

What are the limitations or risks? (privacy, outdated data, misuse)

Outdated or incomplete data: If the BIN database isn’t updated frequently, it may miss new BIN ranges, leading to false declines or incorrect routing.

Privacy concerns: Collecting and storing detailed card metadata can raise customer privacy issues and may conflict with data protection regulations if mishandled.

Misuse of data: Detailed BIN information could be exploited by fraudsters or unscrupulous actors for profiling or targeted attacks.

Impact of tokenization: As networks move to tokenized transactions, traditional BIN Lookup becomes less effective since real card numbers are hidden.

Dependence on external providers: Relying on third-party BIN Lookup APIs means merchants and PSPs could face service outages or data quality issues beyond their control.

Rapid growth in BIN Lookup API providers for real-time merchant use

The rapid growth of BIN Lookup API providers has enabled merchants to perform real-time card data verification, enhancing fraud detection and streamlining the checkout process by instantly accessing up-to-date card issuer information.

Factors Driving Growth of BIN Lookup API

Enhanced Fraud Prevention: Real-time BIN data flags suspicious transactions by revealing issuing bank, card type, and origin country, helping detect geographic mismatches and unusual patterns.

Improved Payment Processing & Optimization: BIN info enables merchants to route transactions to processors with better acceptance rates, reduce fees, and apply dynamic currency conversion.

Reduced Chargebacks: Early fraud detection lowers chargeback rates, saving merchants significant costs and protecting their reputation.

Increased Compliance: Helps merchants meet PCI DSS, GDPR, PSD2 by verifying transaction legitimacy and securing cardholder data handling.

Improved Customer Experience: Smoother, safer checkouts build trust and boost customer satisfaction through optimized processing and fraud reduction.

Rise of Digital Payments: Growing online transaction volume creates demand for instant, reliable BIN data to manage risks and speed.

Example BIN Lookup API Response

JSON:

{

"bin": "411111",

"brand": "Visa",

"type": "Credit",

"country": "US",

"bank": "Chase Bank",

"currency": "USD"

}

The Rise of BIN Lookup APIs and Free BIN Lookup Tools

The growth of BIN Lookup API providers allows merchants to perform real-time verification and fraud filtering instantly. APIs now integrate machine learning, compliance filters, and Fast Funds Eligibility indicators for advanced payout verification.

Fast Funds Eligibility and Advanced API Features

✅ Modern APIs (like Cybersource BIN Lookup) can return:

✅ Payout eligibility (instant or delayed disbursement)

✅ Account funding source (debit, credit, prepaid)

✅ Issuer country and BIN length (6 or 8 digits)

✅ Network and card platform (consumer, commercial)

✅ These capabilities empower fintechs to deliver faster refunds and accurate fraud screening.

Use of BIN data in advanced machine learning fraud systems

Feature enrichment: BIN data adds valuable attributes (issuer, card type, country) that models use to detect patterns and anomalies.

Anomaly detection: Helps flag transactions where the card’s issuing country doesn’t match the customer’s location or device IP.

Risk scoring: BIN details combine with other data (transaction amount, device fingerprint, velocity checks) to produce real-time fraud risk scores.

Adaptive learning: Machine learning models use historical BIN-related fraud cases to improve predictions and adjust to emerging fraud trends.

Reduced false positives: By understanding normal behavior linked to certain BINs, systems can avoid wrongly declining legitimate customers.

Integration with real-time APIs: Live BIN data feeds keep models up to date, boosting accuracy in detecting high-risk transactions.

Regulatory focus on privacy and proper handling of card data

Data protection laws: Regulations like GDPR (EU), CCPA (California), and others require merchants and processors to handle BIN and card data responsibly and transparently.

PCI DSS compliance: Payment Card Industry Data Security Standard mandates strict controls on storing, accessing, and transmitting cardholder data, including BIN details when linked to other sensitive info.

Purpose limitation: Regulators emphasize that BIN data should be used only for legitimate purposes like fraud prevention, compliance, or transaction routing — not for profiling or marketing without consent.

Data minimization: Collect only what’s necessary; avoid over-collecting detailed card metadata that increases privacy risks.

Customer transparency: Merchants and payment providers must inform users how card data (including BIN info) is processed and safeguarded.

Accountability & audits: Businesses must document how they use BIN data and be ready to demonstrate compliance to auditors or regulators.

Effectiveness of BIN Lookup alone vs. AI-based fraud detection

✅ BIN Lookup alone:

Strengths:

👉 Fast, lightweight check that instantly reveals issuer, card type, and country.

👉 Helps catch simple mismatches (e.g., card issued in one country but used elsewhere).

👉 Easy to implement; low cost.

Limitations:

👉 Can’t detect complex fraud patterns like synthetic identities, account takeovers, or coordinated bot attacks.

👉 Relies on static data; outdated BIN lists reduce accuracy.

👉 Lacks adaptability to new fraud tactics.

🤖 AI-based fraud detection (with BIN data):

Strengths:

👉 Analyzes multiple data points: BIN info, user behavior, device data, transaction history, velocity, and more.

👉 Detects subtle, evolving fraud patterns beyond what static rules can catch.

👉 Continuously learns from new fraud attempts, improving accuracy over time.

Limitations:

👉 Higher cost, more complex integration.

👉 Requires quality data and careful tuning to avoid false positives.

👉 Model transparency can be limited (black-box risk).

BIN Lookup for Other Industries (Healthcare & Insurance)

BINs aren’t only for bank cards. In healthcare and insurance, RX BIN numbers route prescription claims through PBMs (pharmacy benefit managers) and health plans.

Including a short reference improves semantic coverage for queries like rx bin lookup, insurance bin lookup, pharmacy bin number lookup, and payer-specific searches (e.g., Aetna / Cigna / BCBS rx bin number lookup, Medicaid bin number lookup).

Note: RX BINs are claim-routing identifiers, not payment card BINs. Still, the shared “BIN” concept makes this a high-intent adjacent topic for users who search “rx bin number lookup.”

BIN Lookup FAQs

What is a BIN number lookup?

It’s a tool that identifies the issuing bank, card type, and country using the first 6–8 digits of a card number.

What is the difference between BIN and IIN?

They’re identical; Issuer Identification Number (IIN) is the newer ISO term replacing BIN.

Can BIN lookup detect fraud?

Yes — it detects mismatches in geography, card type, or issuer details to flag risky transactions.

How accurate are free BIN lookup tools?

Accuracy depends on update frequency and data sources. Paid APIs typically maintain verified databases.

What does the first digit on a card mean?

It’s the Major Industry Identifier (MII) — defining the card’s industry (e.g., Banking, Airlines, Travel).

Conclusion: Where Experts Agree and Diverge

Experts agree that BIN Lookup remains a cornerstone of secure payments, yet its future lies in AI-driven intelligence and tokenized ecosystems.

As regulations tighten and networks evolve, data freshness, privacy, and integration flexibility will define the next generation of BIN Lookup APIs.

Try Vizovcc’s BIN Lookup API → Verify, Prevent, Protect.